Financial Statement Analysis - Key Accounting Ratios

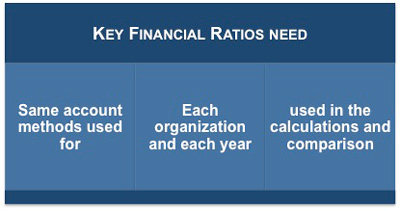

Key accounting ratios may not be directly comparable between organizations that use different accounting methods. Most public organizations are required by law to use generally accepted accounting principles for their home countries, but private organizations, partnerships, and sole proprietorships generally have more freedom in reporting their accounts.

This Key Financial Ratios Checklist details the key financial ratios you can use to help you interpret financial information. This Financial Ratio Formulas Checklist provides you with a list of the most popular financial ratios used to assess an organization's performance, solvency, profitability and investment potential. This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession.

|

Before you start your calculations you will need to make sure that the accounting treatments are the same when making comparisons. This is not only between the organizations you wish to compare but also for each year you wish to compare.

For example: An organization may change policy and decide:

• To capitalize research and development, holding it in the balance sheet as having a long-term value, or

• It may consider development costs as overheads as soon as they are incurred.

Either treatment is perfectly reasonable, but comparing figures that have been arrived at in these two different ways would be pointless.

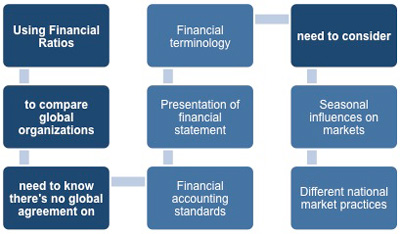

When you need to make comparisons with global organizations it is important to remember that there is no international standard. How an organization calculates the summary data presented in all financial statements, as well as the terminology used, is not always consistent between organizations, industries, countries, and time periods.

|

If you are trying to make global comparisons then you need to appreciate how operational differences within each industry or country can impact the validity of such a comparison. These differences include such things as seasonal conditions and traditional industry practices.

For example:

Travel organizations operate under seasonal conditions that are mainly influenced by educational, religious, and constitutional holidays.

Automobile manufacturers in the United Kingdom have two annual registrations of new vehicles. These events cause two large peaks in car sales.

Ensure your investigation in this area is thorough, as such operational differences are so predictable that people in these industries take them as read and rarely mention them. If you remain ignorant of such issues then your ratios will give you misleading information.

For example:

If you were investigating the European car industry then you would need to be aware that in the United Kingdom new vehicle sales peak in March and September. In fact, there are typically five times as many cars sold in March as in the previous month. If you did not allow for this, because you were not aware of the operational practices of the UK automotive industry, then some of your calculations could be meaningless.

Anyone who did not know about the sales variations in the UK's automotive industry could draw the wrong conclusion if they compared accounting ratios for February, March, and April. An automotive dealership would appear to have too much capital tied up in stock in February and far too little in April, when in fact this is simply a reflection of the market that it is operating in.

This example illustrates why it is important to know something about how an organization operates and what the accepted practices are within that industry before drawing conclusions from key accounting ratios. If you need a basic financial accounting principles pdf then download our free eBook now.

You may also be interested in:

Financial Statement Analysis | Types of Key Accounting Ratios | Current Ratio Analysis | Calculating Profit | Business Performance Ratios | Price/Earnings Ratios | Price-to-Book Ratio | PEG (Price/Earnings to Growth) Ratio | Dividend Yield.