Financial Statement Analysis

The ability to analyze the financial position of another organization is a valuable skill for any manager to have, whether you are choosing a supplier, considering a strategic partnership, or trying to work out how much credit to extend to a customer. Many organizations can appear successful despite deep structural problems with the way they are financed and managed. Just think for a moment about the consequences of working with a supplier or partner organization who goes bust, or who, despite appearing credible, never seems able to deliver on their promises because of hidden financial problems within their own organization.

Very few managers take the time and trouble to learn how to make a simple financial analysis of another organization, even though doing so is straightforward and the necessary information can usually be obtained online either free of charge or for only a few dollars.

Our 'Financial Performance' eBook explains the tools used to assess the financial performance of an organization. These are known as 'key accounting ratios' and they help you interpret financial information in a way that can aid you in making the right decisions when choosing who to work with or sell to. This information can also give you a valuable insight into how well an organization is managed at the highest level. This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession.

|

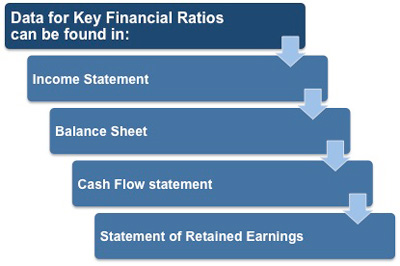

A key accounting ratio is calculated by comparing certain values taken from an organization's financial statements, including the income statement, balance sheet, and cash flow statement. Before you can fully understand accounting ratios you must have a clear and accurate appreciation of how each of these statements is derived and what it can tell you.

If you are not already familiar with these statements then please download and study our eBooks on Income Statements, Balance Sheets and Cash Flow. If you need a basic financial accounting principles pdf then download our free eBook now.

|

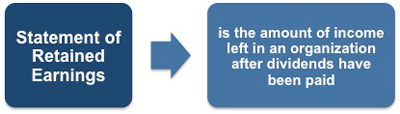

The purpose of the statement of retained earnings is to explain the changes in the retained earnings account and in dividends over a period of time.

|

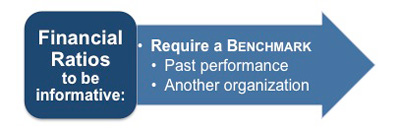

Generally speaking, accounting ratios are not useful unless they are benchmarked against something else, for example past performance or another organization in the same business area. Whilst you can compare the ratios of organizations in different industries, this is usually of limited value because of differences in market conditions, capital requirements, and competition.

|

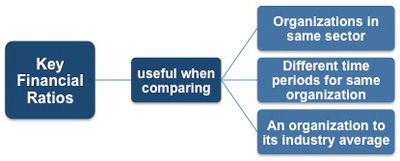

key accounting ratios allow for useful comparisons between:

1) Organizations in the same industry sector

2) Different time periods for the same organization

3) An organization and its industry average

|

Comparing accounting ratios for different industries can be interesting from a purely academic point of view or can help with investment decisions, but is of limited use to you as a manager. However, comparing ratios for potential suppliers, partners, acquisitions, or competitors can provide you with useful data to help with decision making.

You may also be interested in:

Key Accounting Ratios | Types of Key Accounting Ratios | Current Ratio Analysis | Calculating Profit | Business Performance Ratios | Price/Earnings Ratios | Price-to-Book Ratio | PEG (Price/Earnings to Growth) Ratio | Dividend Yield.