Financial Statement Analysis - Price-to-Book Ratio

The price-to-book (P/B) ratio represents the value of the company if it is broken up and sold. The book value usually includes equipment, buildings, land, and anything else that can be sold, including stock holdings and bonds.

|

To calculate this ratio the market price of an organization's shares (share price) is divided by its book value of equity.

The latter is also known as the 'price-equity ratio' and is found on the balance sheet by subtracting the book value of liabilities from the book value of assets.

|

For example: If an organization has:

• Total assets of $200 million

• Of which $150 million made up from intangible assets and liabilities

• 25 million shares outstanding

• A market share price of $6

Then its book value of equity is ($200m - $150m) = $50m ÷ 25m = $2

Where an organization has a very high share price relative to its asset value it is likely that it has been earning a very high return on its assets.

You may also find instances where an organization is trading for less than its book value (P/B <1) and this tells an investor that either:

1) The asset value is overstated - meaning there is a chance that the asset value will face a downward correction by the market, leaving investors with negative returns.

2) Return on assets is genuinely poor - indicating that new management or a new operating environment will prompt a turnaround in prospects and give strong positive returns.

3) Or a new owner can break up its asset value, earning a profit for shareholders.

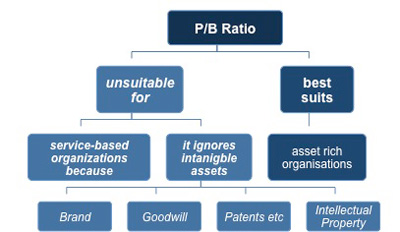

The P/B ratio is really only useful when you are looking at capital-intensive businesses or financial businesses with plenty of assets on the books.

|

It is not meaningful for service-based organizations because due to accounting rules intangible assets such as intellectual property (brand name, goodwill, patents, and trademarks) are ignored in calculating the book value of equity.

If you need a basic financial accounting principles pdf then download our free eBook now. This Key Financial Ratios Checklist details the key financial ratios you can use to help you interpret financial information. This Financial Ratio Formulas Checklist provides you with a list of the most popular financial ratios used to assess an organization's performance, solvency, profitability and investment potential.

You may also be interested in:

Financial Statement Analysis | Key Accounting Ratios | Types of Key Accounting Ratios | Current Ratio Analysis | Calculating Profit | Business Performance Ratios | Price/Earnings Ratios | PEG (Price/Earnings to Growth) Ratio | Dividend Yield.

|

|

|