Accounting Concepts - Cash Accounting

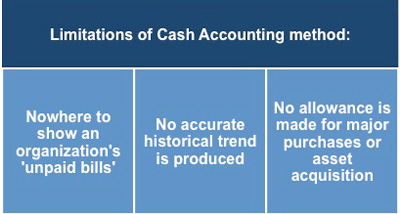

In cash-based accounting, expenses are not recorded until they have been paid, which means that there is nowhere on the books to show unpaid bills.

|

These limitations can create serious problems if the business is much more complex than Suzy's Signs. In fact, cash-based accounting can create a situation that leads to insolvency while reporting that the organization is making a profit.

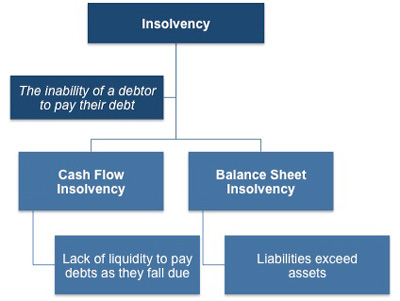

When an organization is termed 'Insolvent' it means: The inability of a debtor to pay their debt and can result from either cash flow insolvency or balance sheet insolvency. The definitions of these two types of insolvency are:

- Cash flow insolvency involves a lack of funds to pay debts as they fall due.

- Balance sheet insolvency involves having negative net assets. In other words, the business owes to others more than it has in assets including the money that it is owed.

|

Many people confuse bankruptcy with insolvency and it is important to understand the difference. An organization may be cash flow insolvent but balance sheet solvent if it holds assets that it cannot turn into cash if it needs to do so.

Conversely, an organization can have negative net assets showing on its balance sheet but still be cash flow solvent if ongoing revenue is able to meet debt obligations, and thus avoid default. (Many large corporations operate permanently in this state.)

Bankruptcy is not the same as insolvency. It is a determination of insolvency made by a court of law with resulting legal orders intended to resolve the insolvency.

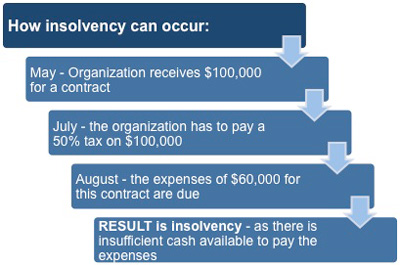

To illustrate why cash-based accounting can lead to insolvency, imagine an organization that receives income prior to completion of the job, but where major costs are not paid out until after completion. This could lead to a situation where the organization receives say $100,000 in sales for the period, but most of the associated costs (say $60,000) do not appear on the income statement for that period.

Consequently, the income statement shows a profit for the period, which is overstated by the $60,000 in as yet unpaid costs. The organization is then taxed on this notional profit. Several weeks later, the $60,000 expenses need to be paid, but there is no cash available because it has already been paid out in tax. The organization is now insolvent.

|

This is a very simple example, but in many organizations there may be large amounts of money flowing through the business and profits may appear to be high. As time goes by, cash deficits accumulate year after year and with the unpaid expenses not recorded, the cash-based income statement will report that the business is profitable even though it may be insolvent.

Another problem with cash-based accounting is that it does not create an accurate historical trend of business operations. This is because transactions are recorded only when cash changes hands. It does not (as a rule) represent the sale date of goods or services. Major purchases or other asset acquisitions can also distort the picture.

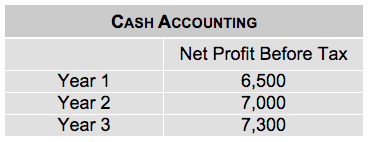

This can be illustrated using the Suzy's Signs example and looking at her first three years income statement figures, shown in the table below. These cash-based net profit figures appear to show a steady growth year on year. But to fully understand her growth you need to know more about her costs.

|

What these figures are unable to show are:

- Her set-up costs - including office furniture, computer, printer, and stationery. These were allocated to her first year, even though she is still getting the benefit of these things in years two and three.

- Her outstanding invoices - by the end of her third year this amounts to $4,000.

This is a substantial amount given the size of her business and yet it does not appear anywhere in the accounts. In order to overcome the problems associated with cash-based accounting, most organizations use an alternative system called accrual accounting and this is dealt with next.

You may also be interested in:

Accounting Concepts and Conventions | Basic Accounting Concepts and Financial Statements | Cash Accounting | Accrual Accounting | Basic Accounting Terms | Revenue Recognition Principle | Matching Principle | Example Income Statement.