Reading a Balance Sheet

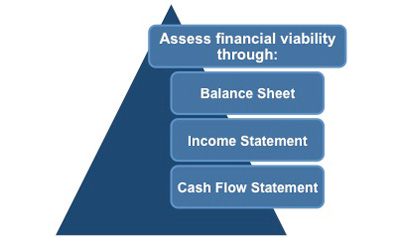

You will increasingly need to be able to communicate in the language of finance as you progress upwards through the levels of management. This eBook will give you the knowledge to interpret any organization's balance sheet and draw conclusions about its financial performance and profitability.

|

A balance sheet, also known as a 'statement of financial position,' shows a company's assets and liabilities, and the owners' equity.

Together with the income statement and cash flow statement, it makes up the cornerstone of any company's financial reports. If you wish to become more familiar with income and cash flow statements download our free eBooks 'Understanding Income Statements' and 'Controlling Cash Flow.'

As a manager, it is important that you understand how a balance sheet is structured and how to analyze it so that you can take an active role in strategic and business development decision making. These decisions determine which assets are required and how they will be used within the organization to attain its mission or goal.

|

The main concept of a balance sheet is that total assets must equal the liabilities plus the equity of the company at a specified time. When you describe assets in this way it shows you how they were financed. This is either by borrowing money (liability) or by using the owner's money (equity).

|

Most organizations need both staff and resources in order to deliver their goods or services. Even a self-employed designer working from a home office will need a computer and some office furniture. A large manufacturing corporation may have millions of dollars worth of buildings, as well as office and manufacturing equipment. These are referred to as assets and they are an important part of any business.

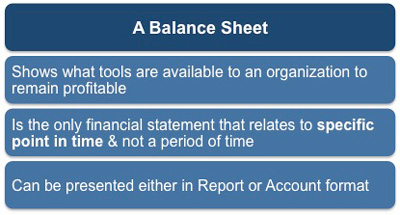

Whether you are looking at your own organization, a competitor, or a prospective partner organization you need to understand how financially sound they are. The balance sheet will tell you if they are profitable, and furthermore what tools are available to make those profits again in the future. A balance sheet is a three-part financial statement that summarizes an organization's

1st. Assets (presented in order of liquidity),

2nd. Liabilities and

3rd. Equity

at a specific point in time.

Unlike the other basic financial statements (income statement and cash flow statement), the balance sheet applies to a single point in time rather than a period of time. This is usually the date that corresponds to the end of an organization's financial year, and consequently the balance sheet is often described as representing a 'snapshot' of a company's financial condition.

An organization's balance sheet can take one of two forms:

• Report form - uses a vertical format to show assets followed by liabilities and then equity.

• Account form - lists assets on the left-hand side and equity plus liabilities on the right-hand side.

For large corporations the balance sheet is an essential element of their annual report and the figures are usually shown alongside those for the previous year.

As stated earlier, the assets are usually listed first (in order of liquidity) followed by the liabilities. The difference between the assets and the liabilities is known as equity and this equity must equal assets minus liabilities.

|

Balance sheets are usually presented with assets in one section and liabilities and equity in the other section with the two sections 'balancing.'

Each of these accounting terms has a very specific meaning when being used in financial statements and it is essential that you have a clear appreciation of each one. If you want to refresh or clarify your understanding of these terms then download our eBook 'Accounting Principles' available from this website.

You may also be interested in:

Assets, Liabilities, and Equity | Assets Definition | Liabilities Definition | Equity Definition | Balance Sheet Explained | Common-Size Analysis.