Income Statement Definition

As a manager, you may be asked to produce or contribute towards an income statement for your own business unit. This provides senior management with an indication of how your business unit is performing against its targets over a specific period, for example quarterly. This eBook you will give you a thorough understanding of the income statement and how it is made up. If you want to refresh or clarify your understanding of these accounting terms then download our eBook 'Accounting Principles' available from this website.

The purpose of an income statement is to be able to measure an organization's financial performance over a specific accounting period. It provides a summary of how its revenues and expenses are incurred, as well as showing if it has made a net profit or loss.

|

The income statement is divided into two parts:

Operating items section - provides information about revenues and expenses that are a direct result of regular organization operations.

For example, if an organization sells garden furniture, then the operating items section would detail the revenues and expenses involved with the manufacture, buying in, and retailing of garden furniture.

Non-operating items section - details any revenue and expense information about activities that are not tied directly to these operations.

In the garden center example, if they purchased a warehouse or more land then this information would be detailed in the non-operating items section.

All the income statements in this eBook are produced based on the accrual method of accounting. You will need to have a basic understanding of this method and other commonly used financial terms to maximize the benefits you will obtain from studying this eBook.

If you are unfamiliar with or unsure of the exact meaning of 'accrual' or other commonly used financial terms, you can find a simple explanation for them in our free eBook 'Accounting Principles.' This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession.

Purpose of the Income Statement

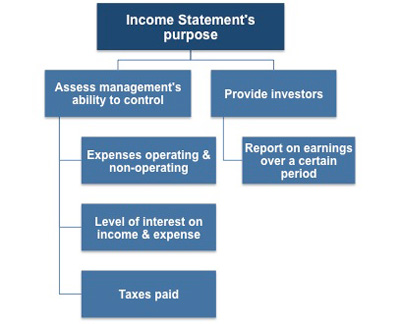

The primary purpose of the income statement is to report an organization's earnings to investors over a specific period of time. It provides important insights into how effectively management is controlling expenses, the amount of interest on income and expense, and the taxes paid.

|

Income statements are used in a variety of ways both internally and externally to aid the decision-making process. For example:

To show how well management is investing the money under its control.

To enable comparisons to be made with an organization's competitors.

To assess an organization's operating performance over a defined period.

To determine the type of investment opportunity the organization represents.

An income statement can also be used to calculate financial ratios that will reveal how well the management is investing the money under their control. It can also be used to compare an organization's profits with those of its competitors by examining various profit margins.

Your role as a manager is likely to find you using an income statement to track revenues and expenses so that you can determine your operating performance for the organization over a period of time. You can also use it to track increases in product returns or cost of goods sold as a percentage of sales.

|

An income statement also allows potential lenders, banks, or investors to assess what type of investment your organization would be for them. These people would also want to look at your organization's balance sheet.

Existing and potential suppliers are interested in reviewing income statements because this helps them to assess what type of credit terms they are prepared to offer your organization - for example, whether or not to ask for pre-payment before they will supply you, or whether to restrict your credit limit.

You may also be interested in:

Income Statement Format | Multiple-Step Income Statement | Income Statement Explained | Operating Expenses Definition | Income Statement Ratios | Common-Size Income Statements | Common-Size Analysis | Income Statement Cash Flow.