Income Statements - Operating Expenses Definition

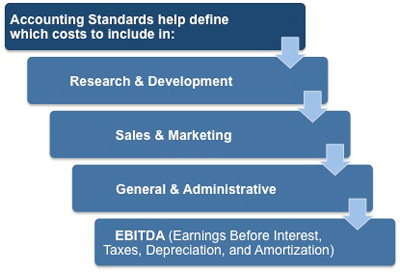

When using an income statement solely within your organization there are accounting standards to help you define which of your expenses should be classified as 'operating' ones. There is some latitude as to exactly where such items should be placed, allowing you to represent your organization's expenses in a way that best reflects its primary activity.

|

The following are considered as an accounting standard and are described in greater detail in this section.

• Research and Development Costs

• Sales and Marketing Costs

• General and Administrative Costs

• EBITDA - Earnings Before Interest, Taxes, Depreciation, and Amortization.

Research and Development Costs

The money your organization spends to create new products or improve existing products is usually referred to as research and development costs, engineering expenses, or product development costs. All the costs incurred in activities to find something new to sell must be financed out of the gross profits and is usually considered to be an operating cost.

Sales and Marketing Costs

The direct costs of making a sale (for example on commissions) are often reported as part of the cost of sales. Beyond those costs directly related to making a sale, your organization invests substantial effort and money in creating and maintaining a sales and marketing presence.

Marketing costs are different from sales costs in that they represent all of those expenditures your organization makes to find out:

• What people want to buy

• How to interest people in its products, and

• How to create prospects for the company's sales force.

Usually none of these costs are directly related to making a sale, yet they are all necessary to create a sales pipeline from prospects through to buyers or customers.

|

Selling expenses represent the cost of actually selling the company's products and services, including putting salespeople into the field, running a telesales operation, distributing brochures, placing advertising, attending trade shows, etc.

General and Administrative Costs

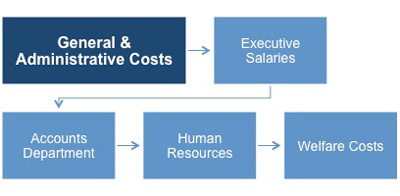

The third common category of expense is general and administrative costs. These are costs that are needed to ensure the efficient running of your organization. This includes everything not grouped under some other heading. If it is not production, research and development, or marketing and sales then it must be general and administrative.

|

The types of costs to include under this heading are executive salaries, accounting, human resources, welfare costs, and all the costs of supporting the company's administrative organization.

EBITDA

This stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Amortization can be defined as spreading payments over multiple periods for loans and intangible assets, such as patents and intellectual property.

It is a modified way of presenting operating income for organizations that are not concerned about the financially based charges that it excludes.

A profit center within an organization does not normally concern itself with how the organization is financed, how it depreciates its assets, and how payments are made.

|

Removing all of these from the calculation gives an operating income at the business unit level. However, EBITDA sometimes appears on published income statements of companies with heavy investments in equipment and a heavy debt load as a way to show the earnings without the burden of these financial charges.

Other Generic Terms

There are some more general items that you need to have a clear understanding of when using an income statement. These are:

• Non-operating Income and Expenses

• Income Before Taxes and Income Taxes

• Net Income

Non-operating Income and Expenses

These items are shown near the bottom of the income statement so that they do not detract from the conclusions a reader may make about how efficiently an organization is run.

The total of these items, whilst typically small in relation to an organization's operation, is not necessarily insignificant. It can become very large in relation to net income where an organization is operating a low profit margin: for example interest income and interest expenses. These are considered financial costs unless the company is in the financial sector (for example selling insurance or banking), in which case they will be operating costs.

Income Before Taxes and Income Taxes

Pretax income or income before taxes is the income that an organization expects to pay tax on and is the amount upon which its income tax estimate is based. Immediately following this item is an income tax estimate usually referred to as a 'Provision for Income Taxes.'

Net Income

This is the bottom line. It is the final financial results of everything the company has done for the period being reported.

This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession. If you need a basic financial accounting principles pdf then download our free eBook now.

You may also be interested in:

Income Statement Definition | Income Statement Format | Multiple-Step Income Statement | Income Statement Explained | Income Statement Ratios | Common-Size Income Statements | Common-Size Analysis | Income Statement Cash Flow.