Income Statement Format

There are a variety of different types of income statements that organizations use, but the most common are the single-step format and the multi-step format.

|

The following sections take you through how each of these formats is produced and what is included in each one.

The Single-Step Format

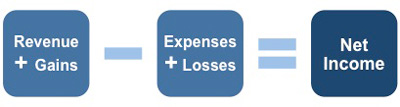

This format for the income statement uses only one subtraction to arrive at net income. Taking away the sum of expenses and losses from the sum of revenues and gains gives a figure for net income.

|

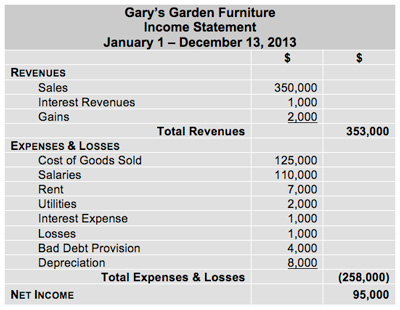

The table below shows you what an income statement created in this way would look like. Then there is an explanation for each of the main sections.

|

Within the heading of an income statement the name of the company, followed by the title 'Income Statement' must appear. On the third line you must specify the exact time period covered by the statement. For example:

• January 1 - December 31, 2013

• Year Ended April 5, 2013

• Quarter Ended March 31, 2013

• Month Ended June 30, 2013

It is extremely important that anyone reading the income statement is aware of the time period that it covers, as the statement can cover whatever period you wish to select or best suits your decision-making process.

Revenues

This is the income that flows into your organization and is used almost synonymously with sales. In government and nonprofit organizations it includes taxes and grants.

Remember not to confuse revenues with receipts. Under the accrual basis of accounting, revenues are shown in the period they are earned, not in the period when the cash is collected. Revenues occur when money is earned; receipts occur when cash is received.

|

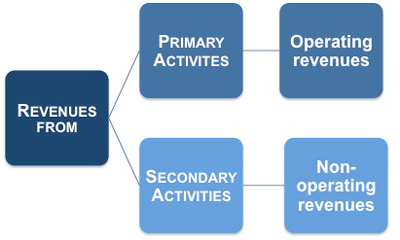

These revenues include all of the payments that are made to your organization during a specified period. This may include payments made for things other than sales or whatever constitutes the primary activity of your organization. The revenues from 'non-primary' activities are itemized separately.

Revenues From Primary Activities

These are often referred to as operating revenues and are only those revenues derived from the provision of sales or services depending on the nature of your organization.

Revenues From Secondary Activities

These are often referred to as non-operating revenues and are those that an organization earns outside of selling goods and services. For example:

• Interest paid to the company by the bank for cash on deposit.

• Payments received for the lease of spare office space.

Gains

These are derived from the sale of long-term assets and are reported on the income statement as the net of two amounts: the proceeds received from the sale of a long-term asset minus the amount listed for that item on the company's books.

For example, if Gary's Garden Furniture sells one of its vans for $7,000, because it is not an organization that deals in the buying and selling of vehicles, the sale of the van is outside of its primary activities.

|

Gary's Garden Furniture sells one of its delivery vans for $7,000. Over the years, the cost of the van was being depreciated on the company's accounting records ($5,000).

As a result, the money received for the van ($7,000) was greater than the net amount shown for the vehicle on the accounting records ($5,000).

Resulting in a gain of $2,000 from the van's sale.

This means that the company must report a gain equal to the amount of the difference - in this case, the gain is reported as $2,000.

Expenses

These are all of the costs incurred during the period. Costs associated with the main activity of your organization are referred to as operating expenses, whereas those associated with a peripheral activity are non-operating expenses.

Expenses Involved in Primary Activities

These are the costs that are incurred in order to earn normal operating revenues. In the example of Gary's Garden Furniture, the cost of goods sold, salaries, rent, and utility costs are all considered normal operating expenses.

The cost of goods sold (COGS) is the costs that go into creating the products that an organization sells. In the case of Gary's, they buy in finished stock and then sell it on. Therefore, the cost of goods sold is the cost of the stock that was sold during the period.

This is calculated by taking the beginning inventory for the period, adding the total amount of purchases made during the period then deducting the inventory remaining at the end. This calculation gives the total cost of the inventory sold by the company during the period.

Rent and Utilities are calculated according to the matching principle. Gary's have not yet received an electricity bill for the final quarter. Since the purpose of the income statement is to present an accurate picture of the finances for the period it needs to recognize this liability even though no invoice has been received. They know that last year's bill for the same period was $450 and so they enter a figure of $500 as a realistic estimate for this quarter.

Expenses from Secondary Activities

These are referred to as non-operating expenses. For example, interest expense is a non-operating expense because it involves the finance function of the organization, rather than the primary activities of buying and selling garden furniture.

Losses

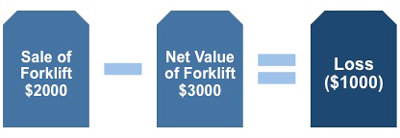

These include things like the loss from the sale of long-term assets or a transaction that is outside of an organization's primary activities. A loss is reported as the net of two amounts: the amount listed for the item on the company's books (book value) minus the proceeds received from the sale. A loss occurs when the proceeds are less than the book value.

|

As in the previous example of selling the van, Gary's is not a vehicle dealer, so the sale of the forklift is outside of the retailer's primary activities. Over the years, the cost of the forklift was being depreciated in the accounting records and as a result, the money received for it ($2,000) was less than the net amount shown for it on the accounting records ($3,000).

This means that Gary's made a loss ($1,000) in this sale and it will be shown as such in the income statement.

Bad Debt Reserve

Even though Gary's is careful about extending credit it does sometimes sell its furniture to buyers who become insolvent or bankrupt before the invoice is paid. This creates a 'bad debt,' which means that payment will never be collected.

Technically, a bad debt becomes a bad debt when the chances of payment become so small as to be nonexistent. From experience Gary's know that around 1% of their total sales will never be paid for and can assume that the 1% bad debt expense has happened when the sale is made.

Even though no check is actually written to cover this percentage, it exists as a total against which actual bad debt can be subtracted.

Depreciation

Fixed assets are those that have a useful and productive life longer than the period of the income statement. Gary's own several items of office equipment, all of which have a useful life of several years. It would be unreasonable to apportion the costs of these to the quarter in which they were purchased.

This problem is overcome by charging only a portion of the cost of these assets to each quarter of their expected useful life. In the case of Gary's Garden Furniture, these fixed assets include company cars, warehouse equipment, personal computers, and office furniture.

Net Income

Gary's Garden Furniture's income statement shows a net income of $103,000.

However, there are some things that should be borne in mind before taking this figure too literally. When preparing this income statement the accountant may have had to estimate certain expenses in order to recognize revenues when they are earned, recognize expenses when they are incurred, or match expenses with revenues.

If you need a basic financial accounting principles pdf then download our free eBook now. This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession.

You may also be interested in:

Income Statement Definition | Multiple-Step Income Statement | Income Statement Explained | Operating Expenses Definition | Income Statement Ratios | Common-Size Income Statements | Common-Size Analysis | Income Statement Cash Flow.