Threat of New Entrants

The number of potential new entrants into a market varies considerably and is a key factor you need to quantify. Sectors that require high levels of investment and expertise are much harder for new organizations to break into and challenge the existing providers, which protects the profit levels of the existing players.

If your market is one that has a common technology base, little brand awareness or loyalty, and is one in which the distribution channels are accessible to all sizes of organization, then you will usually find it is easy for new rivals to enter your market.

On the other hand, if your market requires the acquisition of patents or proprietary know-how, many potential new entrants will be deterred because of the large up-front investment required. It is also more difficult for new rivals to enter a market if brand loyalty is high, as your customers are far less likely to switch to another brand.

|

New rivals may also be prevented from entering your market sector if the distribution channels are restricted.

There are several barriers that can prevent additional rivals entering the market. If you are an existing supplier then you have the opportunity to create or capitalize on this competitive advantage.

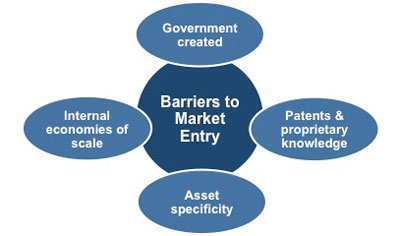

These barriers to entry can come from a variety of sources:

• Created by governments

• Patents and proprietary knowledge

• Asset specificity

• Internal economies of scale

• Barriers to exit

Sometimes governments create or permit what are seen as 'natural' monopolies, such as utility organizations. In this instance it is seen as more beneficial to the consumer to have one provider that is regulated by an industry body than it is to have several providers competing.

A significant entry barrier for many modern markets is one of proprietary knowledge or patents, which provide their organizations with a significant competitive advantage for a period of time. This time enables them to recover their investment and become profitable.

In a similar way, those industries that require an organization to invest in highly specialized equipment and technology or plants create a barrier to potential entrants because of the monies involved. This is compounded by the fact that the equipment or technology cannot be easily used for other products or services. This is known as 'asset specificity.' Existing organizations in this situation will aggressively defend their market share and investment from potential rivals.

Many markets are only attractive to organizations if they can attain levels of production and costs that give them internal economies of scale. This is called the Minimum Efficient Scale (MES) and is a commonly known figure for many industries. The higher the MES figure the greater the deterrent it is to entering a market.

Finally, where an organization is unable to leave a market, it has to compete. This is known as a barrier to exit, and it operates in a similar way to barriers to entry. Profitability can be high in a situation where organizations have both high entry and exit barriers as long as all providers operate efficiently.

Difficulties in exiting a market are most likely to occur where there are inter-related businesses within it, in situations that require an organization to acquire specialist assets, or where there are high exit costs, for example decommissioning units or equipment. If your organization's assets can easily be disposed of, there are few costs involved if you want to withdraw, and the operating unit is independent of your main organization then you are operating in a market that is easy to exit.

You may also be interested in: Introduction to Porter's Five Forces Analysis, Competitive Rivalry, Threat of New Entrants, Threat of Substitutes, Bargaining Power of Suppliers, Bargaining Power of Customers and Advantages and Disadvantages of Porter's Five Forces Analysis.