Competitive Rivalry

One of the keys to success for organizations is their ability to understand their competitors' actions and marketing strategies. The degree to which rivalry exists among competitors varies between industries and the market sectors within them.

Regardless of the number of key competitors your organization faces it is vital for its longevity that you understand the differences between your rivals. This knowledge is essential when developing your strategy, and it cannot be achieved by simply using two indices, e.g. size of organization and market share, or sales revenue and market value.

|

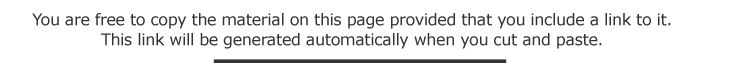

There are two indices that are commonly used when judging your competitive edge and those of your rivals:

• CRx - Concentration Ratio

• HHI - Herfindahl-Hirschman Index

The Concentration Ratio (CRx)

This ratio measures the total output produced in an industry by a given number of corporations. It will be expressed by using its initials followed by a number. For example,

CR4 gives the market share of the four largest companies

CR5 gives the market share of the five largest companies, and so on.

Concentration ratios are usually used to show the extent of market control of the largest firms in the industry.

Concentration ratios range from 0 to 100 percent. The levels reach from No, Low, or Medium, to High and 'Total' concentration.

If for example CR4=0%, the four largest firms in the industry would not have any significant market share. If CR4=100% then the four largest firms would account for the total market share.

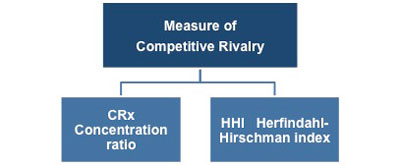

The following diagram illustrates the CR5 Concentration Ratio of four UK industry sectors that are close to monopolies.

|

The diagram shows that for both the sugar and tobacco sectors the top 5 companies account for 99% of the market share. The top 5 suppliers of oils and fats account for 88% of the market share, while the top 5 suppliers of gas account for 82%.

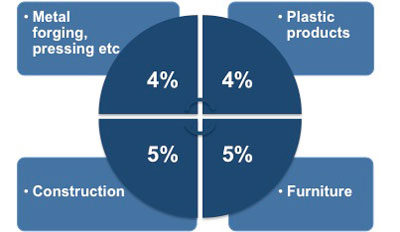

In those sectors where the Concentration Ratio is low there are many rivals and no one organization has a substantial market share. Competition in such markets is high. Those sectors within the UK that have the lowest CR5 ratios are shown below.

|

In all of these sectors the five largest producers account for only 4-5% of the total market share.

The Herfindahl-Hirschman Index (HHI)

This is also referred to as the Herfindahl Index, and it is more complex than the CRx. For the purposes of this eBook it is only important that you understand that it measures the size of organizations in relation to the industry and indicates the amount of competition amongst these organizations. The HHI also gives a greater weighting to larger organizations.

|

This index ranges from a value of zero, which indicates a very large number of small organizations, to one, which represents a monopoly. Therefore the closer the HHI Index is to zero the greater the level of competition within the sector.

There are published figures available for these indices that can offer you an insight into the degree of competition in your sector. You can look these up using the SIC (Standard Industrial Classifications) that match or are a best fit for your operations.

Factors Affecting Competitive Rivalry

There are several things that increase the intensity of rivalry that you are likely to experience:

• A larger number of firms

• Slow market growth

• High fixed costs

• High storage costs

• Low switching costs

• Low levels of product differentiation

• High exit barriers

The larger the number of organizations involved in a market the greater the level of rivalry. This is because the organizations have more competition when trying to win customers and buying resources so rivalry can be quite aggressive. This becomes more intense the more equal each company's market shares is as they all strive to become the market leader.

|

The same aggressive rivalry can be seen where the market is growing slowly. Organizations will be experiencing declining sales, both in terms of revenue and volume, and will strongly defend their existing market share, while attempting to gain a greater share.

In markets where fixed costs make up the majority of the total costs, organizations need to produce at full capacity to ensure they achieve the lowest unit costs through economies of scale. These high volumes mean that the organization has to adopt a hard line when fighting for market share against its rivals.

Where organizations have a product that is highly perishable or has high storage costs they are always seeking to be the first to market so that they can achieve the best prices. This creates an environment of intense competition to win customers.

In circumstances where it is relatively easy for a customer to switch between products and suppliers rivalry will also be high. A good example of this can be seen in wholesale fresh vegetable, meat, and fish markets. This situation also illustrates another influence on the intensity of rivalry: where there is little differentiation between your product and that of your competitors. The effect of this can, however, be reduced by developing and maintaining a strong brand identity for your product.

There are circumstances where the costs of abandoning the investment in the specialist assets required to manufacture your product are too great. When faced with high exit barriers most organizations continue to operate despite the product often being unprofitable.

The competitive forces are not static; they alter in response to changes within their environment and the impact of technological advances. Many industries have seen changes in the dominance of the market leaders as new entrants and technology alter the dynamics of a market. For example:

The introduction of Smartphones by Apple and Samsung seriously reduced the market share of previous market leaders like Nokia.

In the world of books, Amazon has completely changed consumer expectations about the level of choice and delivery times. The addition of eBook readers, such as the Kindle, and instant downloads has further intensified the level of competition in this once conservative market.

These factors often lead to price wars and hard-hitting advertising campaigns, as well as the launching of additional product ranges in an attempt to retain market position.

|

There are several strategies organizations adopt when protecting their market share in situations of intense competition:

• Altering pricing policies

• Improving product differentiation

• Seeking ways to use channel distribution more creatively

• Exploiting relationships with suppliers

• Improving service levels

Historically, one of the most popular strategies for gaining market share was to cut prices. This approach carries serious risks as it is easy for competitors to do the same and this has the effect of resetting your customers' expectations in terms of price. By reducing your revenue you also limit your ability to invest in research and promotion, which may further weaken your position if your have a brand name to protect.

Organizations generally prefer to grow or maintain their market share by improving the unique features their products offer in comparison with those of rivals. However, this is not a strategy available to straightforward, uncomplicated products.

Another important strategy, which is more suitable to some products than others, is to make use of a new distribution channel. For example:

In 1995 Dell computers used the Internet to allow customers to specify their requirements and have a PC built to their own specifications. Selling direct to customers in this way made it impossible for traditional electrical retailers to compete on range or price.

In other instances a large retailer or manufacturer can use their market position to gain preferential prices from their suppliers. This allows them to be more profitable or sell at a lower price without reducing their profit margins. Alternatively, they could use their influence to encourage the supplier to produce a branded or special edition product exclusively for them, which can also give them an advantage over their rivals.

For many organizations, improving the level of service they provide offers a significant opportunity to gain or retain market share. For example:

Next-day delivery has made Internet suppliers, such as Amazon, competitive with high street retailers. You can order when the stores are closed and get your book or DVD the next day. The benefit is that you've made your purchase from your home or office without the inconvenience of having to visit the store when it's open.

In some cases, altering your service levels can provide you with an element of differentiation that is difficult for your rivals to replicate.

You may also be interested in: Introduction to Porter's Five Forces Analysis, Competitive Rivalry, Threat of New Entrants, Threat of Substitutes, Bargaining Power of Suppliers, Bargaining Power of Customers and Advantages and Disadvantages of Porter's Five Forces Analysis.