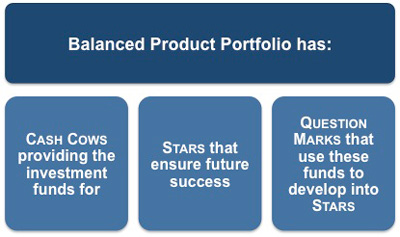

A Balanced Portfolio

A balanced portfolio within an organization allows it to position itself so that it is ideally situated to take advantage of its current and future market growth opportunities.

|

For example, Cash Cow products provide investment funds that can be used to convert today's Question Marks into tomorrow's Stars.

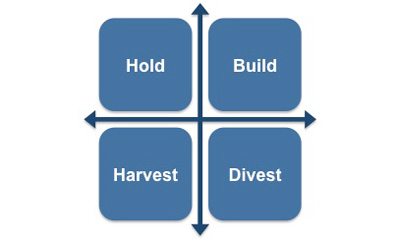

Once a balanced portfolio has been defined, your organization can choose to apply the most appropriate of the following four strategies:

Hold - you choose to continue doing the same things to maintain the status quo.

Build - you select to make further investments, either to maintain the market share of a Star, or make a Question Mark into a Star.

Harvest - you decide to utilize your cash flow from a Star or Cash Cow to reduce the burden of investment and maximize profits.

Divest - sell off or withdraw Dogs so that human resources and financial capital can be invested in your Star and Question Mark products and business units.

The Boston Matrix can also be used to understand how well your current portfolio matches your organizational objectives. This can help to identify areas that you need address in order to achieve a balanced portfolio. It also offers an alternative perspective to that of looking solely at the life cycles (product portfolio analysis) of each product.

|

A balanced portfolio is not achieved by having a product in each quadrant of the matrix, but this is often what happens in reality because not all of your products or business units will be successful and not all of your markets will be growing at the same rate. For example,

Dial-up internet was at one time a Cash Cow for many companies, but as technology has advanced it has quickly become a Dog.

Some companies have retained this product to ensure a full range of products for its customers. They feel the benefits of retaining it as part of their product range outweigh those of removing it from their portfolio.

Others have sold this product off to specialist companies or just stopped supporting it, preferring to use these funds to develop other services.

One common misconception about the Boston Matrix as it relates to a balanced portfolio is that it endorses the idea of diverting funds from a Cash Cow to either a Star or a Question Mark. Whilst it might make sense to do this under certain circumstances, it is not something that is implied by the model.

Another misconception is that a balanced portfolio means having equal numbers of products or services in each quadrant. Again, this is not something that is implied by the model. If your product range does not have a Dog it would not make sense to create one just so that you can have a product in each quadrant.

Your organization can also use the Boston Matrix to indicate its products' strengths and weaknesses in terms of its cash flow management. This is gauged by the amount of cash each product generates (relative market share) compared to the quantity it uses (market growth rate).

By using relative market share, rather than profits, the Boston Matrix ensures that it considers more than just cash flow. The relative market share illustrates the positioning of your product or service compared to your main competitors. It can also help you to decide on future positioning and which marketing activities are likely to be the most effective.

You may also be interested in: Introduction to the Boston Matrix, Classifying Products and Business Units, Stars, Question Marks, Cash Cows, Dogs, Using the Boston Matrix at Brand Level, A Balanced Portfolio and Advantages and Disadvantages.