Cash Flow - Financing

Financing activities include the inflow of cash from investors such as banks and shareholders, as well as the outflow of cash to shareholders as dividends as the organization generates income.

|

Other activities that impact the long-term liabilities and equity of the organization are also listed in this section. These include:

Bank Debt - The net amount of any increases or decreases in monies borrowed from the bank.

Dividends - a profitable organization may elect to pay a distribution of profits to its owners. This is usually done in the form of a dividend on the shares held by its stockholders.

These distributions are almost always in cash and the cash flow statement is the only place such payments can appear.

Net Cash Flow

This is the sum of all the entries preceding it and should be equal to the actual change in cash balances from the beginning to the end of the period of the report.

The final step in this statement is to add to this line the beginning balance of cash that appeared in the prior month's balance sheet. This will give the new ending balance of cash.

In this way the statement of cash flow is tied into the income statement (first line of cash flow statement) and the balance sheet (last line).

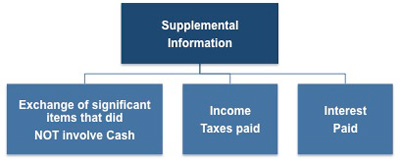

Supplemental Information

This information does not actually appear on the report itself but is usually appended to it.

|

It reports the exchange of significant items that did not involve cash and details the amount of income taxes paid and interest paid.

|

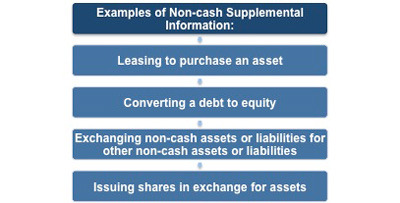

Non-cash activities may be disclosed here including:

• Leasing to purchase an asset

• Converting debt to equity

• Exchanging non-cash assets or liabilities for other non-cash assets or liabilities

• Issuing shares in exchange for assets

The importance of being familiar with a cash flow statement has been explained. The compilation and integration of facts provided in this type of statement make it an excellent analysis tool. This tool allows you to compare accounts that have been prepared using different accounting methods, such as various timeframes for depreciating fixed assets.

|

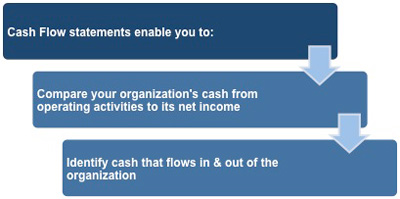

All the figures that you read in a cash flow statement can be found within the other key financial statements. There are a variety of ways you can utilize the information a cash flow statement presents. This statement also offers those who know how to interpret its contents the opportunity for further investigation into an organization.

Some of the most common uses of a cash flow statement are shown in the diagram below:

|

There are two methods of presenting a cash flow statement: the direct and indirect method. The principal advantage of the indirect method is that it focuses on the differences between an organization's net income and its net cash flow from operating activities. This means that it presents a useful link between the statement of cash flows and the income statement and balance sheet.

Because it shows the data contained in an income statement information on a cash basis rather than an accrual basis, the direct method may lead to the incorrect conclusion that net cash flow from operating activities is equally able to measure an organization's performance as its net income. If you need a basic financial accounting principles pdf then download our free eBook now.

You may also be interested in:

Cash Flow Analysis Definition | Managing Working Capital | Cash Flow | Changes in the Cash Account | Direct Format Cash Flow Statement | Indirect Format Cash Flow Statement | Cash Flow from Operations | Cash Flow from Investments.