Cash Flow - Operations

The first line under the Operations title is Net Income because the prime objective of this report is to show the differences between net income and net cash flow. This Net Income figure should be the same as that shown on the income statement for the same period.

Adjustments

|

Then you need to work through the meaning of each of the items listed under the heading 'Adjustments.' These are all the operating items that had an impact on cash that were not included in the income statement.

• Depreciation

• Accounts Receivable

• Prepaid Expenses

• Inventory

• Accounts Payable

Depreciation

Because the cash was all paid out when Gary's bought the asset, the monthly charge for depreciation expense must be removed from reported net income. In other words, it should be added back in to increase the net income.

Remember, depreciation is the gradual charging of the cost to expense over the useful life of the item. It is recorded each month after the asset is put into use yet no cash changes hands as a result of these depreciation entries.

Accounts Receivable

At the beginning of the period, Gary's Garden Furniture was owed money by customers who had bought on credit. Some of this would have been collected during the month, which would increase the cash figure but decrease the accounts receivable figure.

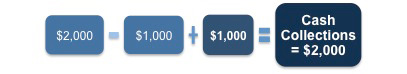

However, Gary's would also make additional credit sales during the period, some of which would remain unpaid. These must also be allowed for. This can be done using the following formula:

|

This calculation effectively converts sales to cash collections by comparing the balances of Accounts Receivable from the beginning of the month and the end of the month. The following examples will help ensure that you understand this aspect of the statement.

Example 1

An organization makes sales of $1,000; because there has been no change in the accounts receivable, the cash account must have increased by $1,000.

|

• Accounts receivable at the beginning of the month = $2,000

• Accounts receivable at the end of the month = $2,000

• Sales = $1,000

Example 2

An organization has made $1,000 worth of sales and accounts receivable has decreased by $1,000. Therefore, the cash account must have increased by $2,000.

|

• Accounts receivable at the beginning of the month = $2,000

• Accounts receivable at the end of the month = $1,000

• Sales = $1,000

Example 3

An organization has made $1,000 worth of sales and accounts receivable has increased by $500, to a total of $2,500. Therefore, the cash account must have decreased by $500. (The negative cash figure of $500 would appear in brackets on the cash flow statement.)

|

• Accounts receivable at the beginning of the month = $2,000

• Accounts receivable at the end of the month = $2,500

• Sales = $1,000

This means that the organization has sold more to its customers during the month that it has collected. It has effectively loaned its customers $500. This may be acceptable if sales are growing but this situation has the potential to cause a liquidity problem if it is not addressed.

Prepaid Expenses

Prepaid Expenses represent an upfront cost for things like insurance. As with accounts receivable, the net change in the balance of prepaid expenses on the balance sheet from the beginning to the end of the period is a quick way to calculate the net effect of this adjustment on cash flow.

|

Basically, if the net figure of prepaid expenses has decreased over the month, there will be a corresponding increase in the cash balance and vice versa.

Inventory

Most companies need some inventory on hand and the change in inventory balances works on the cash account in the same way as Accounts Receivable.

|

Remember that the income statement includes the cost of all inventory sold in the month. The cash flow statement must deduct the cash cost of any inventory added during the period. This can be done using the following formula:

|

Conversely, the cash flow statement must add the cash cost of any inventory deducted during the period.

Example 1

An organization has purchased $1,000 worth of inventory, which it has not sold.

This means that the cash flow adjustment must deduct the cash cost of any inventory added.

In this case the cash adjustment would be minus $1,000 and the figure would be shown in brackets.

• Inventory at the beginning of the month = $2,000

• Inventory at the end of the month = $3,000

|

In this case the cash adjustment would be minus $1,000.

Example 2

An organization has $1,000 less of inventory than it had at the beginning of the period.

This indicates that the organization has sold $1,000 worth of goods out of inventory and has not had to spend any cash to replace it.

This results in the cash adjustment being plus $1,000.

• Inventory at the beginning of the month = $2,000

• Inventory at the end of the month = $1,000

|

In this case the cash adjustment would be plus $1,000.

Accounts Payable

The Accounts Payable figure represents those amounts owed to creditors. The cash flow statement must add the cash cost of any increase in accounts payable during the period as this represents money effectively borrowed from creditors.

This can be done using the following formula:

|

Example 1

The accounts payable figure has increased by $1,000. This means that the organization has effectively borrowed an additional $1,000 from its suppliers this month.

In this case the cash adjustment would be plus $1,000.

Accounts Payable at the:

• Beginning of the month = $2,000

• End of the month = $3,000

|

Example 2

The accounts payable figure has decreased by $1,000. This means that the organization has effectively paid back $1,000 to its suppliers this month.

In this case the cash adjustment would be minus $1,000.

Accounts Payable at the:

• Beginning of the month = $2,000

• End of the month = $1,000

|

You may also be interested in:

Cash Flow Analysis Definition | Managing Working Capital | Cash Flow | Changes in the Cash Account | Direct Format Cash Flow Statement | Indirect Format Cash Flow Statement | Cash Flow from Investments | Cash Flow from Financing.