Direct Format Cash Flow Statements

It would be possible for you to create a report that listed all of the individual cash transactions as shown in Gary's cash account for January and February. But it does not really add to what you can already see on the bank statement because it doesn't show inflows and outflows in any meaningful way.

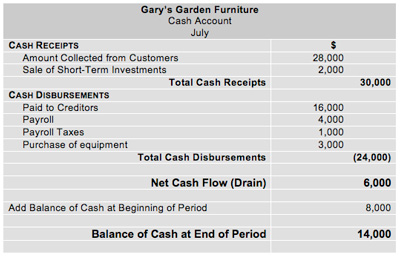

Grouping cash payments together and showing a total movement in cash over a particular period is much more useful. The report below shows Gary's Garden Furniture cash receipts and disbursements for July.

|

By applying the resulting net cash flow ($6,000) to the balance of cash at the beginning of the period ($8,000), it is possible to obtain the cash balance for the end of the month ($14,000).

Showing the flow of cash into and out of the organization in this way provides a summary of the cash account. Unfortunately, it does not show net income or make any attempt to explain the difference between any net income and net cash flow.

As well as these shortcomings, it is difficult to analyze these figures in any meaningful way. Consequently, published accounts always use what is known as the indirect method of presentation.

This is the format that appears in all published financial reports of public companies and is the same format as the report produced by most accounting software. If you need a basic financial accounting principles pdf then download our free eBook now.

You may also be interested in:

Cash Flow Analysis Definition | Managing Working Capital | Cash Flow | Changes in the Cash Account | Indirect Format Cash Flow Statement | Cash Flow from Operations | Cash Flow from Investments | Cash Flow from Financing.

|

|

|