Managing Working Capital

Many organizations that fail are profitable at the time, and their demise often comes as a surprise to managers and staff who can see that there is a full order book and plenty of satisfied customers. In these circumstances, the reason for the failure is usually down to a shortage of working capital.

|

This shortage in working capital can cause a company to not be able to pay its workers or suppliers even though there are sufficient sales and profits. Even in cases where these short-term liabilities can be met, the deterioration of cash flow critically undermines a company's ability to reinvest in the business and, ultimately, to survive.

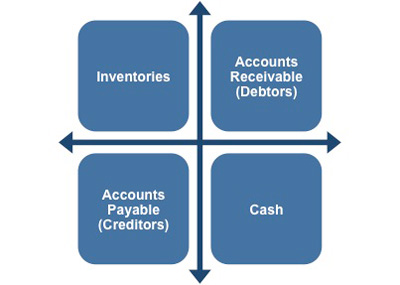

The four factors that affect the amount of working capital available within an organization are:

|

The management role that you perform may only influence one of these areas directly, but having a clear understanding of them all will give you an insight into how well your organization controls its working capital, and by extension how well it is managed financially.

Debtors

These are entities that owe your organization money. Many organizations have problems caused by the slow payment of invoices and this in turn affects working capital and, in particular, liquidity.

Chasing up unpaid invoices can be very time consuming and there is a fine line between maintaining a good working relationship with your customers and upsetting them by demanding payment too aggressively.

Whatever your organization's policy is in the area of debt collection you will need to set expectations appropriately with customers and be polite but assertive in following through with requests for payment. This is a key area you need to monitor closely to ensure problem payers are identified as soon as possible.

|

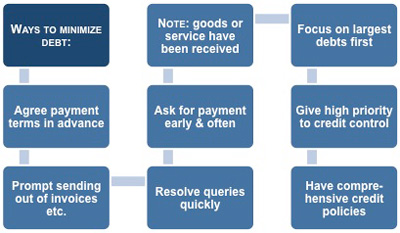

There are some things you as a manager may be able do to help:

• Make sure that the payment terms are agreed in advance

• Send out invoices and statements promptly

• Deal with queries quickly and efficiently

• Ask early and ask often, preferably by telephone

• Remember you are only asking for something that has been previously agreed

• Give credit control highest status and priority

• Have comprehensive credit policies

• Concentrate on the biggest debts first

This Debtor Assessment Template will help you to assess your debtors and to see which ones pose the biggest financial risk. It also enables to quickly identify any products or services for which you may wish to adjust your terms of sale.

Inventory/Stock

Your aim should always be to keep stock as low as realistically possible and to achieve a high rate of stock turnover. In this way you are minimizing the impact on your organization's working capital. In theory this is an ideal to work towards, but in practice it is more difficult to achieve because you have to meet the commitments you have given to customers.

|

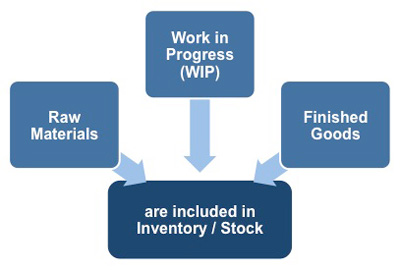

There are three components to what accountants refer to as inventory:

Raw materials - these are the materials required to produce goods.

Work in process (WIP) - includes partly finished goods and those raw materials and components already committed to production.

Finished goods - are all those goods ready to be sold.

Many large and successful manufacturing companies use the just-in-time technique of arranging deliveries from suppliers frequently and in small quantities. This is not easy to achieve and can cause problems if just one vital component is missing when it is required.

Many organizations have sophisticated stock control systems, which keep track of stock levels. Once a pre-determined level of stock is reached, an order is automatically generated so that items are never entirely out of stock. In this way minimum levels of stocks are held and supply is replenished often overnight.

Creditors

Many organizations adopt a policy of delaying the payment of suppliers as long as possible. There is an obvious advantage in adopting such a policy as the purchaser is effectively getting an interest-free loan from the supplier.

|

If your organization adopts this policy then your cash balance will be higher than would otherwise be the case even though slow payments do not affect the net balance of working capital. However, there are also some disadvantages in a policy of slow payment:

- Suppliers will be reluctant to give discounts

- They may treat you as a problem customer and make all of your requests the lowest priority

- If you are always a slow payer there will be less scope for taking longer to pay in response to a crisis

- Within your industry you will quickly gain a reputation as a poor payer and many suppliers may refuse to work with you, making it hard to change suppliers if the need arises.

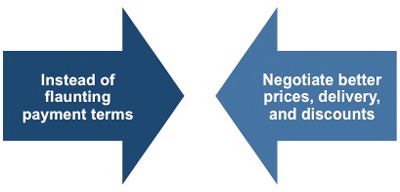

For these reasons, it is often unwise to adopt a consistent policy of slow payment, at least with important suppliers. It is often better to take only a few days longer than the deadline stipulated in the contract and to ensure that this is rewarded with keen prices, timely service, and prompt payment discounts.

|

If your organization is relatively small you may be able to obtain the same price as your larger competitors by agreeing an immediate payment plan with the supplier. This is because many large corporations use their extensive purchasing power to justify paying suppliers after an unreasonably long time.

This sort of policy can leave many manufacturers and suppliers with serious cash flow problems. In these circumstances, many suppliers are prepared to offer the maximum possible discount in exchange for guaranteed quick payments, irrespective of the size of the order.

This Creditor Assessment Template will help you to assess your creditors and to see which ones offer you the best terms and who is the most beneficial for you to develop your relationship with.

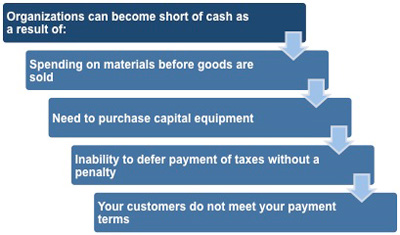

Cash

It is quite common for an organization to be profitable but short of cash.

|

There are several reasons why this can happen:

- An expanding organization will have to spend money on materials (items for sale and salaries) before it completes sales and gets paid. It is a fact of business life that purchases and expenses usually come before sales and profits.

- Capital expenditure, in the form of buying equipment, has an immediate impact on the cash available. Even if the equipment is bought on credit, the monthly payments may exceed the monthly depreciation figure.

- Money may be collected from customers more slowly than expected. This often happens when sales people are motivated to bring in revenue but have no responsibility for, or interest in, enforcing the payment terms.

To avoid your organization becoming 'cash insolvent,' it is essential that you and all the company's managers accurately forecast and monitor their area's cash receipts and payments.

As a manager you need to plan for the known costs and to allow some contingency for unanticipated problems, e.g. late payment by a customer or a supplier withholding raw materials until payment has been processed.

This type of planning is usually referred to as a cash flow forecast and should be part of your overall budgeting management process.

|

As you plan and prepare your cash flow forecast it will highlight areas where improvements or savings can be made. It also has the additional benefit of identifying potential problem areas.

For example,

The figures for cash payments from trade debtors will be based on an estimate of the average number of days' credit that will be taken. This will pose the question of whether or not payments can be speeded up.

Your contingency plans could involve deferring an investment for a few weeks or negotiating an additional overdraft with the bank. Either way a well-planned cash flow forecast document helps you to be proactive and to avoid the crises that usually result from running out of cash. If you need a basic financial accounting principles pdf then download our free eBook now.

You may also be interested in:

Cash Flow Analysis Definition | Cash Flow | Changes in the Cash Account | Direct Format Cash Flow Statement | Indirect Format Cash Flow Statement | Cash Flow from Operations | Cash Flow from Investments | Cash Flow from Financing.