Equity - Balance Sheet Definition

Equity is the difference between total assets and total liabilities. While it is sometimes thought of as indicating the value or worth of the business, this is not really the case because assets are listed at their cost value minus accumulated depreciation rather than their actual market value.

|

In order for the balance sheet to balance, total assets on one side have to equal total liabilities plus shareholders' equity on the other.

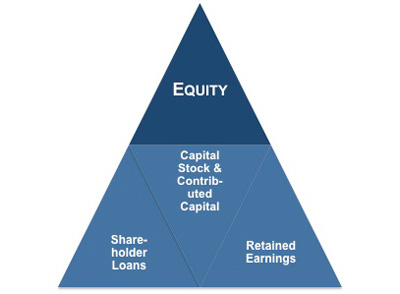

The items that will appear under this section are:

• Loans from Shareholders

• Capital Stock and Contributed Capital

• Retained Earnings

Shareholders' equity is the initial amount of money invested into a business. If, at the end of the fiscal year, a company decides to reinvest its net earnings into the company (after taxes), these retained earnings will be transferred from the income statement onto the balance sheet into the shareholders' equity account. This account represents an organization's total net worth.

|

Loans from Shareholders

This is often seen on the balance sheets of privately owned organizations such as Fred's Factory that is operated by its owners. This is how an owner can put money into their organization when it is needed and take it back again when it isn't.

Banks and other institutional lenders may require that such balances remain unpaid as long as the organization has outside loans.

Capital Stock and Contributed Capital

Capital stock is the amount paid into the organization by investors to purchase stock at some nominal amount per share. In the case of Fred's Factory they have received $10,000 capital stock and a further $5,000 contributed capital from investors.

Retained Earnings

Every commercial organization from its inception develops a history of profits and losses. In times of profit these can be added to retained earnings and when losses are incurred it reduces these retained earnings. Fred's as an organization has operated with overall profitability and has been able to accumulate $46,000 as retained income.

Earnings are often retained within an organization as they enable the management to expand and purchase capital equipment or other fixed assets as dictated by their growth strategy. In circumstances where an organization has made a sustained loss this item may be described as a 'Deficit in Retained Earnings.'

This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession. If you need a basic financial accounting principles pdf then download our free eBook now.

You may also be interested in:

Reading a Balance Sheet | Assets, Liabilities, and Equity | Assets Definition | Liabilities Definition | Balance Sheet Explained | Common-Size Analysis.