Liabilities - Balance Sheet Definition

On the other side of the balance sheet are the liabilities. These are a company's legal debts or obligations that arise during the course of business operations. Liabilities include loans, accounts payable, mortgages, deferred revenues, and accrued expenses.

|

Within this section of the balance sheet you will find the total figures under the following headings.

• Current liabilities

• Long-term liabilities

• Equity

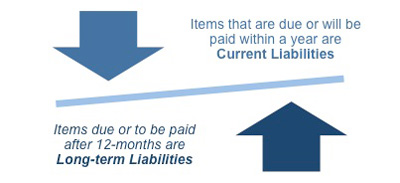

Like assets, they can be both current and long term. Long-term liabilities are debts and other non-debt financial obligations, which are due after a period of at least one year from the date of the balance sheet.

|

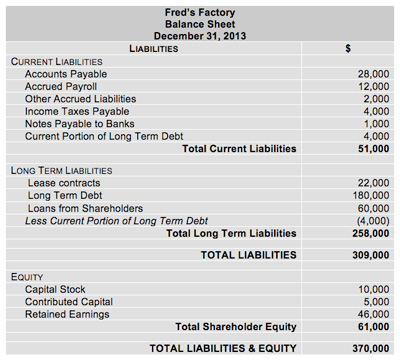

The table below shows how the liabilities section of Fred's Factory's balance sheet would look.

|

Current Liabilities

Current liabilities are those that will become due, or must be paid, within one year. They usually include payables such as wages, accounts, taxes, and accounts payable, unearned revenue when adjusting entries, portions of long-term bonds to be paid this year, and short-term obligations (e.g. from purchase of equipment).

In this example these items are listed under the following headings:

• Accounts Payable

• Accrued Payroll

• Income Taxes Payable

• Other Accrued Liabilities

• Notes Payable and Other Bank Debt

• Current Portion of Long-term Debt

Accounts Payable

This includes all of Fred's bills as yet unpaid from suppliers and service providers. It is usually the first item listed under current liabilities. The amounts in this category should be listed in accordance with the trade terms on the supplier invoices, for example 30 days, 60 days, etc.

Accrued Payroll

This represents the amount earned by Fred's employees, but which has not yet been paid to them. This is because employees are paid in arrears for time they have already worked. Every organization has some amount of money owed to its employees but not yet paid.

Other Accrued Liabilities

These include expenses that Fred's Factory has incurred for which they have not yet received an invoice. Their finance officer needs to estimate the liability rather than wait for an invoice with an exact figure.

Notes Payable and Other Bank Debt

Within this section, Fred's Factory includes such items as bank loans that represent borrowed money. These loans and its associated repayments typically have special terms and need to be recognized in their own right.

These are not simply trade accounts Fred's Factory has with its suppliers as these items are always shown separately.

Current Portion of Long-term Debt

This is the portion of the debt Fred's has that must be repaid within the next 12 months. This is likely to be something such as the latest interest payment on a 10-year loan.

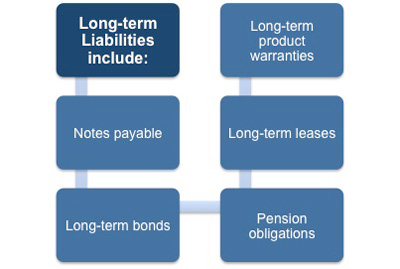

Long-term Liabilities

Under this section heading of the balance sheet Fred's Factory list any long-term liabilities they have. These would be any debts and other non-debt financial obligations, which are due after a period of at least one year from the date of the balance sheet.

|

They usually include issued long-term bonds, notes payable, long-term leases, pension obligations, and long-term product warranties. Liabilities of uncertain value or timing are called provisions.

Long-term debt

Fred's Factory has financing needs that extend for many years and has opted to borrow money with very long payment terms. This enables them to put the money to use in order to earn enough to repay the loan.

In such cases the entire amount of the loan is reported as long-term debt and the portion of this loan that is due to be paid within the next 12 months is shown in the current liabilities. In this example Fred's have a long-term debt of $180,000.

This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession. If you need a basic financial accounting principles pdf then download our free eBook now.

You may also be interested in:

Reading a Balance Sheet | Assets, Liabilities, and Equity | Assets Definition | Equity Definition | Balance Sheet Explained | Common-Size Analysis.