Balance Sheet - Assets, Liabilities, and Equity

By presenting the balance sheet data in three sections, prospective and current investors, plus third parties wishing to work with an organization, can gain an appreciation of what the company owns and owes, as well as the amount invested by the shareholders.

Each of the three segments of the balance sheet will have many accounts within it that document the value of each. For example,

Assets section will usually have accounts for things like stock/inventory, buildings, equipment, and money owed to the company.

Liabilities section will have accounts for money owed by the company to suppliers and its own workers in the form of wages that have not yet been paid.

Equity section will show the net assets, often referred to as shareholder equity, and consists of issued capital and reserves, both controlling interests, as in a parent or holding organization, and non-controlling interest in equity. (The latter, also known as 'minority interest,' is the portion of an organization's stock or shares not owned by the parent. Usually this figure should be below 50% in order for an organization to remain a subsidiary.)

Balance sheets for a large corporation are often quite complex, but once you have learnt how to decipher and interpret each section you will find it an invaluable skill. Once you attain this knowledge you will recognize the importance it plays in aiding your understanding of what really is going on inside an organization and where its potential lies.

This Accounting Terminology Checklist outlines the terminology, concepts and conventions that are accepted within the accounting profession. If you need a basic financial accounting principles pdf then download our free eBook now.

To illustrate this, we have chosen to work through two examples. First, a simple balance sheet a self-employed individual would use and then a typical balance sheet used by a large manufacturing organization.

Simple Balance Sheet Example

Larry's Lawn Cutting is a one-man business that offers a grass cutting service. Larry has just come to the end of his second year in business. He started by cutting neighbors' lawns with his own small grass-cutter. After a year he realized that the best way to make money cutting grass was to work for local schools and parks departments who have large areas of grass.

|

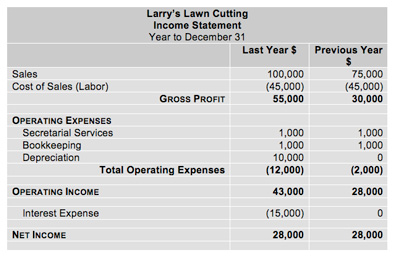

First we need to consider Larry's income statement. The one above shows his two consecutive years side by side for easy comparison between the past year and the previous year.

It is important for Larry to examine his income statement because this is where he can look at his earnings for each year and see how effectively he has managed his expenses. The key findings of this income statement are:

• Sales have increased 33%, from $75,000 to $100,000.

• Gross profit rose by 83%, from $30,000 to $55,000.

• Operating income increased 53% from $28,000 to $43,000.

• Despite both of these substantial increases, his net income remained static at $28,000. The reasons for this are:

• A six-fold increase in his total operating expenses from $2,000 in his first year to $12,000 in the last year. This increase is solely due to depreciation rising from $0 to $10,000.

• Interest expense in the previous year was zero but in the last year it was $15,000.

So non-operating expenses made a significant impact on net income.

Does this income statement show that Larry's business is in better shape in the last year?

Do you have sufficient information in this comparative income statement to draw a conclusion?

It is impossible to tell exactly why these operating and non-operating expenses have arisen from the income statement alone. You can speculate why you think this may have occurred. For example, you might guess that there has been a large expenditure on equipment but it is not possible from the income statement alone to see exactly what assets (in the form of machinery) Larry's company owns.

This can only be determined by looking at a sample of Larry's balance sheet (shown below), as this is where the details of any productive equipment the organization owns is recorded along with how much is left to pay on it.

|

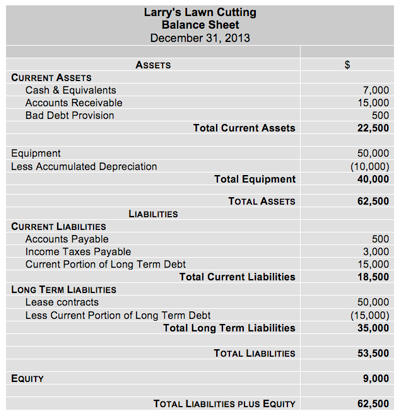

From the balance sheet you can see that Larry has invested $50,000 in equipment.

To buy it, he needed to borrow this amount from the bank and has agreed to pay this back at a rate of $15,000 per year plus interest (over 4 years). This investment was made because Larry realized that even working for 50 hours a week he could only make $28,000 cutting garden lawns as there simply weren't any more hours in the day for him to work. Consequently, he decided to invest $50,000 in a professional grass-cutting machine. This allowed him to work faster and more efficiently. It also enabled him to take on larger contracts for grass cutting in public parks.

As part of this decision-making process Larry would also have looked at his expected revenue for the coming year to ensure the additional revenue would cover the repayment costs. For example, Larry expects to make sales worth around $180,000 as a result of his increased efficiency. This should translate into an income of around $100,000 even allowing for $4,000 to maintain the new machine.

The depreciation for the equipment is listed in the assets section and shows a figure of $10,000 for the year, as he expects it to last for 5 years before it needs to be replaced.

Note that there is no figure for the interest that Larry needs to pay on the $50,000. This is because the interest will only become a liability as it falls due.

Organizations often add 'notes' to their financial statements to provide a narrative explanation of certain items and Larry himself could include an explanation of his reasons for the investment. This would be worth doing if Larry decided to apply for a bank loan or overdraft, as the bank could then see the rationale for his purchase of the machine.

You may also be interested in:

Reading a Balance Sheet | Assets Definition | Liabilities Definition | Equity Definition | Balance Sheet Explained | Common-Size Analysis.